27/08/2019

AM Best Upgrades Credit Ratings of PVI Reinsurance Joint-stock Corporation to B++

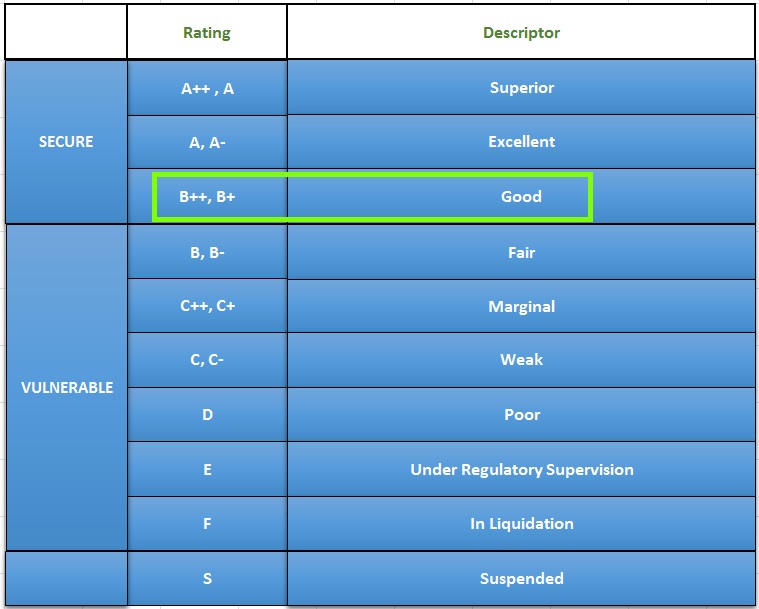

Singapore, 8th August 2019, A.M. Best, the global leader in credit rating, has upgraded PVIRe’s Financial Strength Rating to B++ (Good) from B+, and has upgraded PVIRe’s Long-term Issuer Credit Rating to ‘bbb’ from ‘bbb-‘. The outlook of these ratings is stable.

The rating B++ reflects PVIRe’s balance sheet strength, which AM Best categorizes as strong, as well as its strong and stable operating performance. From 2014 to 2018, the company has a track record of strong performance, with a five-year average combined ratio of 81% and a return on equity ratio of 15%, dividend payout ratio of 15%.

Mr. Trinh Anh Tuan, PVIRe’s CEO said: “We are greatly delighted that A.M.Best has upgraded PVIRe’s rating to B++. This is an important milestone for PVIRe, it reflects strong relationship with our business partners and clients as well as the support of our shareholders. The rating upgrade will also bring us opportunities to co-operate with other reinsurers, brokers and clients. PVIRe will keep working towards the goal of achieving Financial Strength Rating of A- in the near future through efficiency and sustainable growth, capital injection as planned.”

A.M.Best is the world’s leading credit rating agency, focusing on insurance and reinsurance industry. Founded in 1899, A.M.Best has issued ratings of more than 3500 organizations in over 90 countries. B++ rated by A.M.Best is equivalent to BBB+ rated by Standard & Poor’s (S&P), which means that the company has a good ability to meet its ongoing insurance obligations. This is PVIRe’s first rating upgrade since being rated B+ by A.M.Best in 2012. |